- The Federal Reserve is criticized for losing over a trillion dollars and engaging in risky financial practices that could harm the U.S. dollar and global economy.

- The Fed's strategy involves borrowing money from banks at high interest rates and funneling it into government bonds, creating an illusion of financial stability.

- This issue is not limited to the U.S.; central banks worldwide are engaging in similar practices, leading to stifled economic growth and weakened private sector investment.

- The Fed's current predicament is the result of years of unchecked expansion, with its balance sheet growing by 822% since 2009, fueled by risky investments.

- Proposed reforms, such as legislation by Senator Rick Scott, aim to rein in the Fed, establish independent oversight and require transparency through quarterly reports to Congress.

The Federal Reserve, once the bedrock of American financial stability, is now under fire for what critics are calling a reckless and unsustainable gamble with taxpayer money. A former World Bank president has sounded the alarm, revealing that the Fed has lost over a trillion dollars—and counting—turning it into what he describes as "a giant hedge fund for the rich and powerful." This revelation raises serious concerns about the strength of the U.S. dollar and the long-term stability of the global economy.

The Fed’s current strategy involves borrowing money from banks at 5.4% interest and then funneling it into government bonds. This creates the illusion that the government’s financial situation is healthier than it actually is. "It’s worrisome," the former World Bank president stated. "The Fed borrows at 5.4% and dumps it into government bonds. That trade makes the government think it’s better off than it is, encouraging more borrowing when rates were low."

This scheme isn’t just a domestic issue—it’s a global phenomenon. Central banks worldwide are engaging in similar practices, siphoning money from their economies to prop up government debt. The consequences are dire: stifled economic growth, weakened private sector investment and a looming threat to the dollar’s dominance as the world’s reserve currency.

A history of recklessness

The Fed’s current predicament didn’t happen overnight. It’s the result of years of unchecked expansion and a lack of accountability. Since 2009, the Fed’s balance sheet has ballooned from less than 1 trillion to an astonishing 8.3 trillion today—an 822% increase. This growth was fueled by risky investments in mortgage-backed securities and massive interventions in capital markets, far removed from the Fed’s traditional role of purchasing short-term U.S. Treasuries.

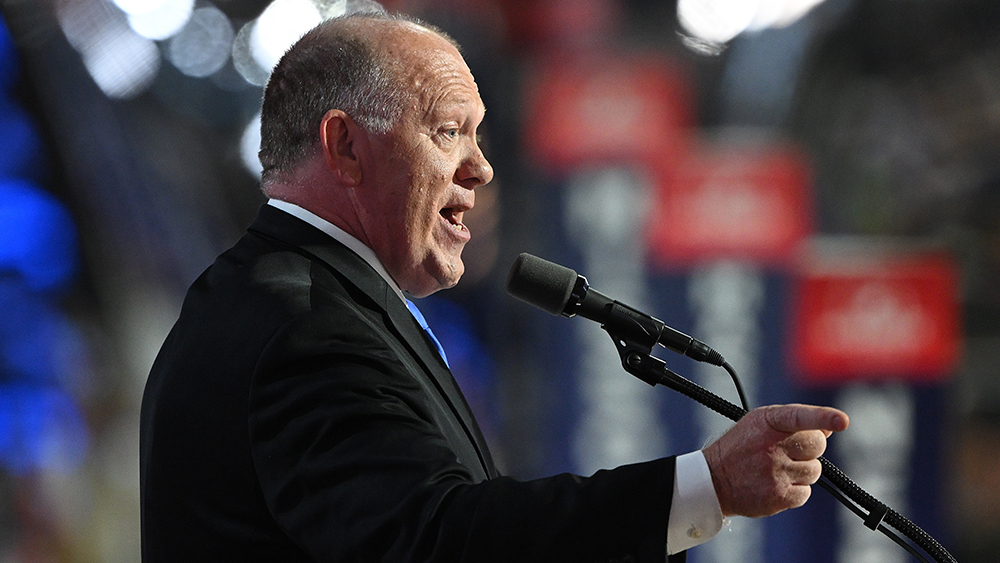

Senator Rick Scott (R-FL) has been one of the most vocal critics of the Fed’s mismanagement. "Jerome Powell might be the only man in American history who has managed to lose more than $1 trillion of taxpayer money in a single year," Scott remarked. He has introduced legislation to rein in the Fed, including measures to mandate compliance with standard banking practices and reduce the Fed’s balance sheet to 10% of U.S. GDP.

The lack of oversight is staggering. The Fed’s inspector general, who earns a cushy $377,800 salary, reports directly to the Fed’s board, creating a clear conflict of interest. Scott’s proposed reforms aim to establish an independent inspector general and require quarterly reports to Congress detailing the Fed’s projected debts and losses.

The global domino effect

The Fed’s actions are not occurring in isolation. Central banks worldwide are engaging in similar practices, creating a dangerous feedback loop. By borrowing from their economies to buy government bonds, these institutions are diverting capital away from productive private sector investments. "This is on a global basis," the former World Bank president noted. "It’s all the major central banks doing the same thing—taking money from the economy to buy government bonds."

This global trend has far-reaching implications. As central banks continue to prop up government debt, they risk undermining the very currencies they are tasked with protecting. The U.S. dollar, long considered the world’s safest asset, is particularly vulnerable. If confidence in the dollar erodes, the consequences could be catastrophic, leading to higher inflation, reduced purchasing power and a potential collapse of the global financial system.

The fiat money trap

At the heart of this crisis lies the inherent flaw of fiat money. Unlike gold-backed currencies, fiat money is created out of thin air by central banks and commercial banks through credit expansion. This system creates an illusion of prosperity, fueling booms that inevitably turn to busts. As Austrian economist Ludwig von Mises warned, "The development of the fiduciary medium must necessarily lead to its breakdown."

The current system incentivizes governments to spend beyond their means, funding everything from welfare programs to military expenditures. This unchecked spending is made possible by the Fed’s willingness to monetize debt, but it comes at a cost: higher inflation, economic instability and a growing burden on taxpayers.

A call for accountability

The time for reform is now. The Fed’s reckless behavior has already cost taxpayers over a trillion dollars, and the losses are mounting. Senator Scott’s proposed legislation is a step in the right direction, but more must be done to restore accountability and transparency to the central banking system.

As the former World Bank president aptly put it, "We need to be clear on this. It’s not money printing—it’s money borrowing, and they’re paying top dollar for it." The Fed’s actions are not just a threat to the U.S. economy; they are a threat to the global financial system. If we fail to act, the consequences could be dire, not just for the dollar, but for the future of free markets and economic liberty.

The Fed’s trillion-dollar gamble is a wake-up call. It’s time to rein in this out-of-control agency before it’s too late. The strength of the dollar—and the stability of the global economy—depends on it.

Sources include:

Please contact us for more information.