Many Americans are already wary of the amount of knowledge and control the government has over our spending habits, but that could get a lot worse when CBDCs come into play. Many governments realize how powerful they will be for redistributing wealth and controlling the masses.

This concept might have sounded a bit far-fetched even five years ago, but if the pandemic has taught us nothing else, it’s that the government won’t hesitate to use its power to control people when it suits them. And if they need to impose lockdowns again for another pandemic – or to help stem climate change, which seems to be the excuse du jour for controlling people lately – CBDCs could easily be programmed to help enforce this by not working unless a person uses them within a certain range of their home.

It's also easy to see how this could have aided the push for COVID-19 vaccination. Some people were offered financial rewards for getting jabbed, and CBDCs could take this one step further, being deposited into accounts belonging to those who roll up their sleeves and even deducted from those who aren’t willing to comply.

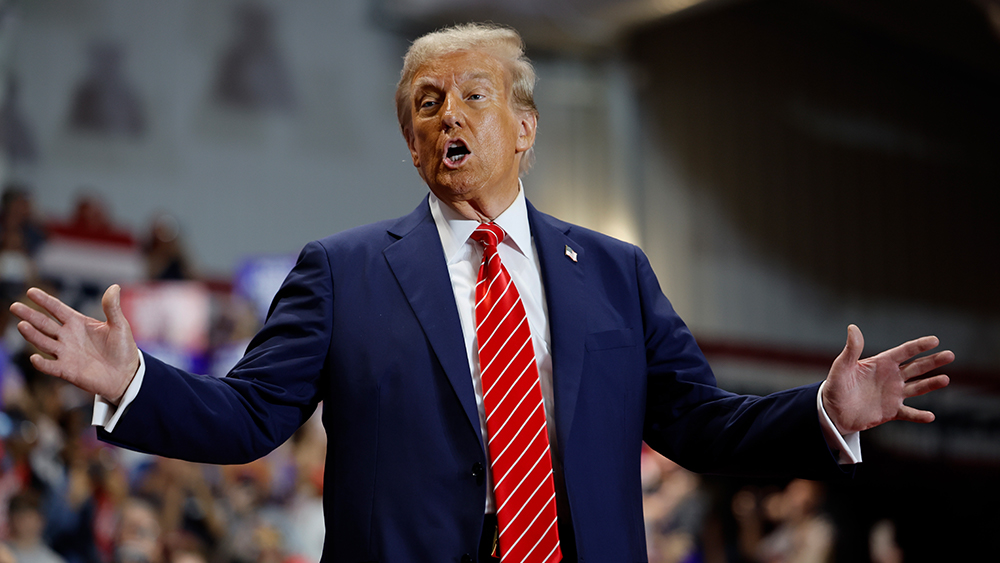

From there, it’s not much of a stretch to imagine these currencies being used for China-style social credit, with people being punished for doing whatever the government feels threatened by, whether it is growing your own food for self-sufficiency, referring to people using the "wrong" pronoun, eating too much meat, or posting about your support for conservative politicians on social media.

CBDCs are destined to fail

As bleak as all this sounds, however, there is still a very good chance this plan could backfire. As investor Nick Giambruno points out, there will be people who want to use other options, and they’ll find a way to make it work.

He writes: “For example, consider that Venezuela, Zimbabwe, Argentina, Lebanon and many other countries restrict the use of US dollars. However, all that does is create a thriving black market—or, more accurately, a free market—for US dollars and a parallel financial system. We can expect the same kind of dynamic if governments impose CBDCs. I have no doubt significant parallel systems and underground markets will naturally emerge.”

The time to start understanding these alternatives is now, however, because CBDCs are going to be forced on many of us soon and it could take a while before they prove to be a failure.

In fact, because CBDCs will inevitably force people to get familiar with digital currencies, they will also make it easier for people to understand and use decentralized digital currencies that can’t be used to control them, censor them, sanction them, or steal from them.

Nigeria was one of the first countries to start adopting a CBDC, but the take-up rate in Africa’s biggest economy ended up being just 1 in 200 despite major governmental efforts to convince people to get on board. There were public protests, a cash shortage and widespread dissatisfaction. Following the introduction of their CBDC, inflation skyrocketed, and many people started adopting Bitcoin, making them harder to control and essentially having the opposite effect of what their government intended.

Of course, there are other problems, too, like the lack of cybersecurity talent available to governments to help ensure their CBDCs are safe from hacking, and constant advancements in AI mean there will be no shortage of sophisticated threats to the system that they will need to stay on top of. Everything from CBDC accounts and exchanges to hardware, digital wallets and the human administrators who keep the system running are points of vulnerability that hackers can exploit.

Although there is a good chance that CBDCs will be a spectacular failure, people who value their freedom need to be prepared and start investing in assets that are harder for central banks to trace and control.

Sources for this article include:

Please contact us for more information.