(Article by Larry McDonald republished from TheBurningPlatform.com)

Now, the Fed is promising endless rate hikes and $1T of balance sheet reduction onto a planet with emerging market and Euro-zone credit markets in flames.

Listen, all I have is an economics degree from the University of Massachusetts, but after having spent the last 20 years trading bonds professionally and embarking on a 20k feet deep autopsy on the largest bank failure of all time – from my seat the current Fed agenda is sheer madness and will be outed very soon.

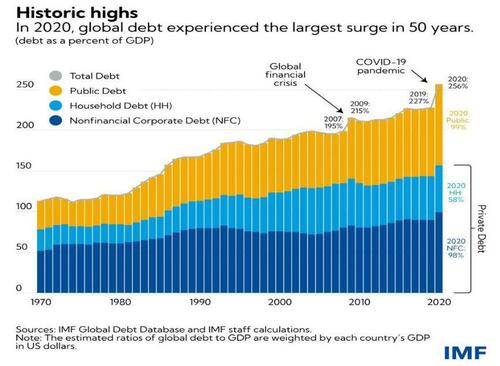

The true cost of capital was distorted for so long, we now have hundreds of academics– clueless to the underlying serpent inside global markets. When the 6 foot seven, Paul Volcker walked the halls of the Marriner S. Eccles Building of the Federal Reserve Board in Washington, our planet embraced about $200T LESS debt than we are staring down the barrel at today. Please call out the risk management imbeciles that make any reference of “Powell to Volcker.”

In 2021, global debt reached a record $303T, according to the Institute of International Finance, a global financial industry association. This is a FURTHER jump from record global debt in 2019 of $226T, as reported by the IMF in its Global Debt Database. Volcker was jacking rates into a planet with about $200T LESS debt. Please call out the risk management imbeciles that make any reference of Powell to Volcker.

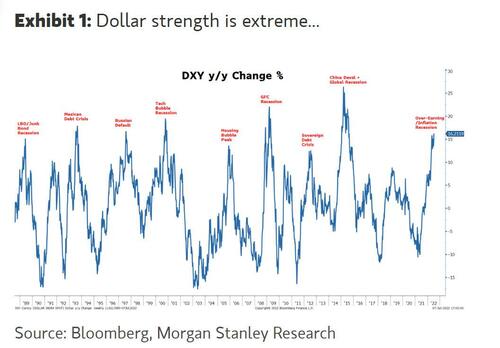

Many economists in 2022 are highly delusional – a very dangerous group indeed. When you hike rates aggressively with a strong dollar you multiply interest rate risk, which was already off the charts coming from such a low 2020 base in terms of yield – it’s a convexity nightmare. Interest rate hikes today – hand in hand with a strong U.S. Dollar – carry 100x the destructive power than the Carter – Reagan era.

At the same time, you add lighter fluid on to the credit risk fire in emerging markets with a raging greenback. Global banks have to mark to market most of these assets. If global rates reset higher and stay at elevated levels, the sovereign debt pile is in gave danger. The response to Lehman and Covid crisis squared (see above) has left a mathematically unsustainable bill for follow on generations. The Fed CANNOT hike rates aggressively into this mess without blowing up the global economy. We are talking about mass – Jonestown delusion on roids.

Then Covid-19 placed a colossal leverage cocktail on top. Emerging and frontier market countries currently owe the IMF over $100B. U.S. central banking policy + a strong USD is vaporizing this capital as we speak.

A dollar screaming higher with agricultural commodities – priced globally in dollars – is a colossal tax on emerging market countries – clueless academics at the Fed are exporting inflation into countries that can least afford it. Emerging – and frontier market countries owe the IMF over $100B – U.S. central banking policy – strong USD, is vaporizing this capital.

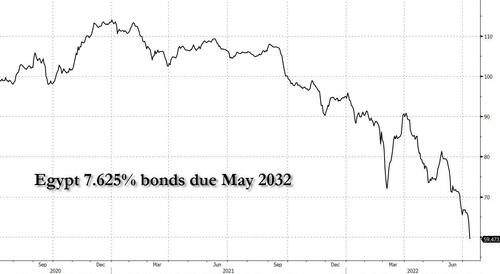

A quarter-trillion dollars of distressed debt is threatening to drag the developing world into a historic cascade of defaults. The number of developing nations trading distressed has doubled, with El Salvador, Ghana, Egypt, Tunisia and Pakistan appearing particularly vulnerable. With the low-income countries, debt risks and debt crises are not hypothetical – try buying oil in USD in an EM currency. A fifth — or about 17% — of the $1.4 trillion emerging-market sovereigns have outstanding in external debt denominated in dollars, euros or yen, according to data compiled by Bloomberg.

Academics at the Fed are exporting inflation into countries that can least afford it – decimating communities all over the planet. The tragedies are piling up. While given cover from their well-placed collection of pawns, tough guy Powell is playing his Volcker act – right out of a scene in a poor man’s poker game. In terms of who's actually running the show – emerging market bonds are plunging 10 points a week and Powell wants you to think he’s got pocket Kings.

Truth is, the global credit risk dynamic has the Aces, and the Fed is looking down at pocket 2s, if that. The IMF has total lending capacity near $1T, Powell is currently wiping out 10% of that. Ultimately, this lost tribe will be coming back, “hat in hand” – yet again to the U.S. taxpayer.

So now we have global bank balance sheets, stressed by $20T to $30T in mark to market losses from Equities, Treasuries, European government bonds, Crypto, Private equity and Venture capital – in the middle of the worst emerging market credit crisis in decades. All after just 150bps of rate hikes from the Fed? Hello?? Anyone home? There are A LOT of bonds that look like this! Oh – by the way – Egypt owes the IMF $13B, the Fed just lit these liabilities on fire.

If the Fed keeps its policy path promises, take the tragedy in Sri Lanka and multiply it by ten across the globe over the next six months. Check-mate FOMC.

Read more at: TheBurningPlatform.com

Please contact us for more information.