Hemp and CBD are some other trendy ingredients that manufacturers are adding to just about everything these days, but will the novelty of CBD-infused cola be enough to save a slowly dying soda industry?

Will cannabis give new life to Big Soda?

Soda sales have been dropping in the United States for over a decade. Consumers are switching from soda to bottled water, coffee and other beverages at a record pace, and Big Soda has been scrambling to keep up. By volume, Americans are consuming less soda every year. While Coca Cola has managed to keep their profits up by selling smaller cans of soda at a higher price per ounce, duping consumers may not be the best game-plan for the long haul.

Conversely, the cannabis market was valued at $9.3 billion in 2016 -- and that number is only expected to increase as time goes on. As more states legalize medical and recreational cannabis, the marijuana industry is expected to see a huge surge in demand -- and most likely, profits.

On the medical side, reports indicate there's a strong preference for extracts and edibles as opposed to smoking. Whether or not it could be enough to keep Big Soda afloat remains to be seen. Coca-Cola is not the only company taking a sip of the cannabis Kool-aid; many beverage makers are looking to launch cannabis-containing products. As Bloomberg reports:

Molson Coors Brewing Co. is starting a joint venture with Quebec’s Hexo’s Corp., formerly known as Hydropothecary Corp., to develop cannabis drinks in Canada. Diageo PLC, maker of Guinness beer, is holding discussions with at least three Canadian cannabis producers about a possible deal, BNN Bloomberg reported last month. Heineken NV’s Lagunitas craft-brewing label has launched a brand specializing in non-alcoholic drinks infused with THC, marijuana’s active ingredient.

Coca-Cola itself is aware of the fact that cannabis is set to be the next big trend in beverages. “Along with many others in the beverage industry, we are closely watching the growth of non-psychoactive CBD as an ingredient in functional wellness beverages around the world,” the company said in a recent statement.

But the fall of soda may not be the only strike against Coke. Studies have shown that young people are increasingly less likely to trust Big Food companies. Recent survey data shows that 43 percent of millennials don't trust Big Food -- while just 18 percent of older generations shared that sentiment.

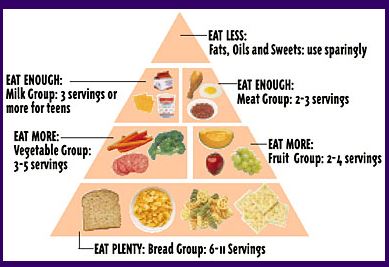

Another 74 percent of millennials say they wish food companies were more transparent. Millennials have been a driving force in the healthy food market. As a group, the younger generation "views its food as healthier, more expensive, more natural/organic, less processed, better tasting and fresh." More, as Natural Products Insider reports, millennials are more likely to believe in the healing powers of food and the preventative benefits of good nutrition.

Simply put, while the younger generation may be highly supportive of the cannabis industry, that support may not carry over well for a scandal-laden Big Food company like Coca-Cola.

See more coverage of stories about our food supply and products at Food.news.

Sources for this article include:

Please contact us for more information.